NicoElNino/iStock via Getty Images

French Real estate companies are interesting, because France allows for, and has several companies that qualify as REITs, or the French-equivalent known as a SIIC.

The company we’re looking at today, Icade (OTCPK:CDMGF), has been a REIT since before the financial crisis in 2007. It has a very interesting portfolio of properties and assets that we’ll go into, and unlike Gecina (OTC:GECFF), its exposure is not primarily offices – at least not to the degree that Gecina has.

Let’s see what Icade can offer investors and why you should consider investing in Icade.

What is Icade?

If you remember my article on Gecina, you’ll see that Icade and Gecina have fairly similar roots. Both companies come out of the post-WW2 French housing shortage, to somehow solve the living space discrepancy in the country. The company became publicly listed as late as 2006, then known as Icade-EMGP, becoming a French REIT in 2007.

Icade is, like Gecina, at an extremely high credit rating considering its business. For Icade, this rating is BBB+. The company has a high yield – over 6-7%, especially with the recent underperformance, so even with high French dividend withholding taxes, this isn’t a poor company to invest in as a dividend seeker.

Traditionally, the company had a mix of office, residential and mixed-use assets in its portfolio. It also had a prop-service segment in its operations. The company abandoned its residential properties back in 2010 after the financial crisis, and its services segment in 2016, leaving it to focus on the segments of real estate assets which it currently owns.

- Office space

- Healthcare space

This makes Icade a mixed Office/Healthcare REIT out of France. It is, to put it in simple terms, a landlord with a GAV of €15B+, with a weighting in primarily offices, secondarily Healthcare, and third business parks.

The future for Icade is clear based on its current corporate strategy. The company seeks to divest Office properties, and gain healthcare properties. Icade also has a development business which, while generating a lot of revenue, is only 10% of EBITDA and isn’t material to understanding the core of Icade.

Since 2007, the company’s healthcare assets have more than increased by 300% in terms of square meters. Unlike Gecina, Icade focuses not only on Paris but other large French cities. Only 15% of the company’s consolidated GAV depends on the company’s Parisian assets and most of them outside of the well-known CBD areas.

Offices are around 50% of the consolidated portfolio. Like its peers, it’s Parisian/Metropolitan vacancy is almost 0%. The company’s healthcare operations are primarily through the 56% majority ownership of Icade Santé, which it owns together with major French insurance companies. The company’s properties are used as clinics, hospitals, and nursing homes, and Santé wants to become an EU market leader in the healthcare asset space and intends to add non-French assets to its portfolio, with a 30% share by the end of 2022. It was less than 7% in 2020. It’s also moving more into nursing homes.

Before this scares you off, realize that nursing homes and eldercare work entirely differently in Europe than it does in the US. Tenants are more liquid, as there’s a higher degree of national ownership, and often times the tenants are the government or governing bodies, making non-payment less unlikely than it is in markets such as the USA.

The challenge with Icade Santé is structural. The company needs to find some way to move forward with this asset, as the minority shareholders, including banks and insurance businesses, have been promised cash. Icade could merge Santé with Icade, or do a full-fledged IPO. The issue here is the stake by Credit Agricole (OTCPK:CRARY), where a merger would mean a massive increase in the bank’s holding company stake, coming into conflict with the public sector financial stake in the holding business.

So, Icade has some things to fix here.

For property development, Icade doesn’t currently have a massive backlog, and can be compared to other, similar companies in Europe such as Vonovia (OTCPK:VONOY), Nexity (OTCPK:NNXXY) (OTC:NXYAF), and others.

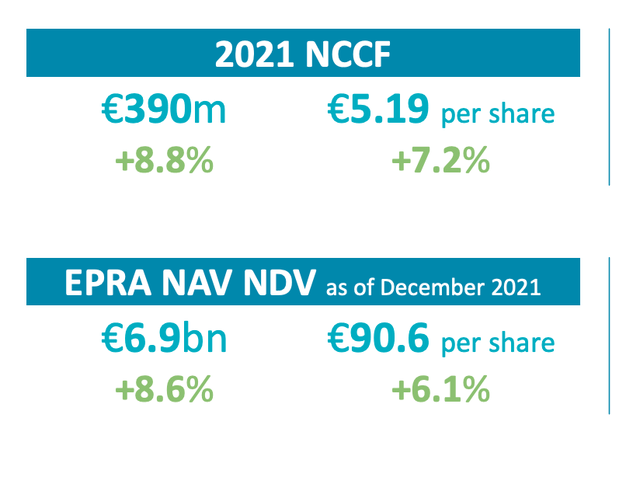

2021 results for the company were impressive. The company reported results that were significantly above posted guidance, as well as increases in the NAV valuation.

Icade 2021 Results (Icade IR)

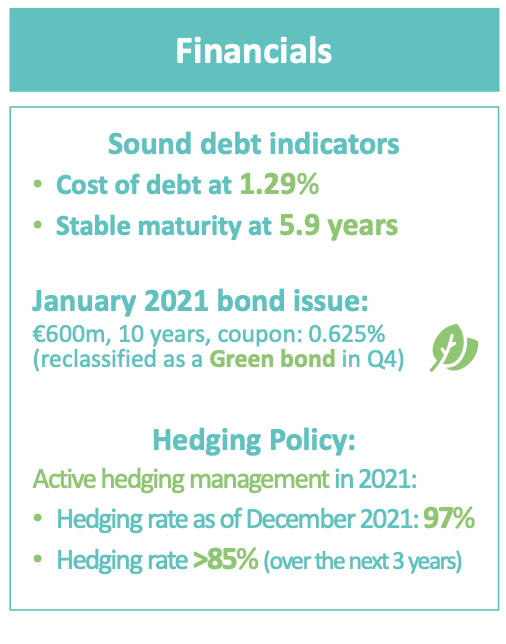

The implications of the excellent performance of course go beyond simple earnings and EPRA NAV. The company’s average debt maturity is now almost 6 years, the company’s cost of debt is down by nearly 20 bps to 1.29%, an insanely low amount reflecting the massive public, near-40% French shareholding in Icade, and the company’s is near the magic ratio of 40% LTV for its assets, at around 40.1%.

Company results are back to pre-COVID-19 levels. The rental income and earnings improvements are on the back of excellent, overall portfolio activity not only in Office but also in Healthcare properties.

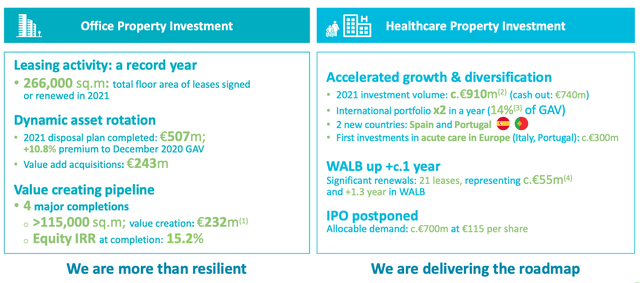

Icade 2021 Portfolio (Icade IR)

The company also saw solid trends in its property development roadmap, with revenues up 30%, another record year with over 6000 new units, and a backlog that’s up 20%.

One of the company’s main strengths here is debt.

Icade Debt/maturities (Icade IR)

The company is gaining market share across its various business lines. Its Office activities were very strong. The company has a December 2021 99% rent collection rate, which should be compared to American REITs, and an office portfolio with an occupancy of 95.3% at year-end, rivaling some mall REITs and even certain residential REITs.

The company has continuing, active development, rotation, and M&A pipeline. Icade had several major completions in 2021, of over 115,000 square meters, with a 15.2% IRR at completion. It also launched another 50,000 sqm worth of projects. In rotation, it successfully sold off €500M worth of assets at 11% above the NAV.

Simply put, this company knows what it’s doing – both in development, acquisition, rotation, and debt. The current valuations of the portfolio that Icade holds call for the office portfolio alone to be valued at €9B. It’s also wrong to say that Paris is the only appealing area in France, with regional growth in Nanterre and other cities up 4-11%.

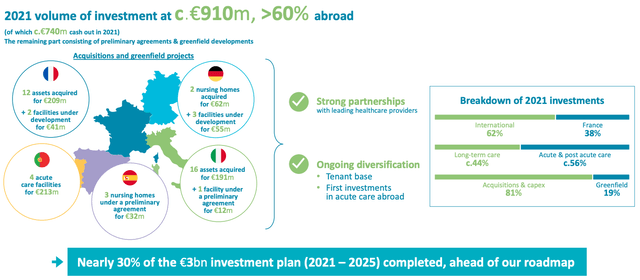

For healthcare, what I view as more interesting, the company is expanding its operations further. Take a gander at some of these fundamental stats, of a 100% financial occupancy rate, 4 new tenants, diversification into Spain and Portugal, growth in rental income, and an 86% portfolio exposure to acute and post-acute care.

These are robust, and diversified cash flows. Speaking for myself, I’m far more comfortable investing in largely nationally-financed healthcare systems such as the ones we’ll find in Europe. The company is well ahead of its roadmap in terms of the healthcare portfolio.

Icade Healthcare Portfolio (Icade IR)

The valuation of this portfolio is now closing in on €7B, reflecting very strong liquidity with valuation for the portfolio up over €600M in 1 year.

Icade is a mixed property/real estate REIT out of France. It’s also owned to 39% by what is essentially the French Government, another 19% by Credit Agricole Assurances, coming close to 50%.

This makes the company like an extension of the French government, which probably makes things easier when it comes to financing loans or going through bureaucratic processes. The government support weighs more than 50% of the development forward revenues.

The company seems to, as of 2021, want to go the IPO route with Santé, and the IPO of the business was slated for late 2021 initially, but the decision for when its IPO’ed has been postponed until market conditions are better.

Overall, there’s a lot to like about Icade – though there ae of course risks that we’ll look at.

Icade Risks

Icade’s risks are primarily related to its reporting, structure, ownership, and technicals, as well as some consolidated versus segment/portfolio data.

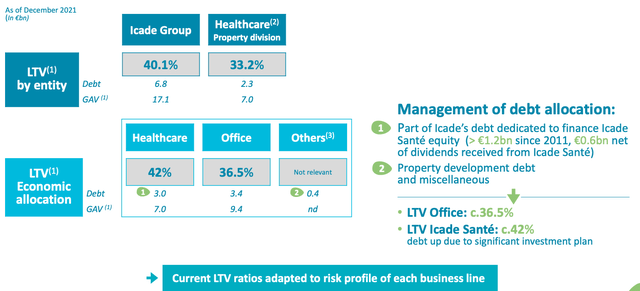

Icade recently changed its reporting method, now to mark-to-market as opposed to depreciated assets. This resulted in a capital gain on the 2021 equity side, which impacts book values. This needs to be accounted for in valuation but can distort the picture of the company. While the company has a 40% consolidated LTV ratio for its portfolio, there’s a higher office-specific LTV than in healthcare. Therefore, the portfolio risk in office is higher than it is in healthcare.

The company has an ambitious disposal pipeline – it’s uncertain, despite recent successes, if this will be important.

Perhaps the largest portfolio-related risk is that most of its office assets are outside the CMD, and in geographies where they really cannot be considered “premium” assets. They are perhaps best considered to be average or decent. The obvious consequence of this is that if things turn down, the company’s assets are likely to be the first affected by the first phases of an overall downturn.

The company’s healthcare portfolio performance is weighing up the slowly rising vacancy in the office side of things – as well as the healthcare yield compression. The company’s development side is also likely to weigh things up here.

However, even with all of this considered, it seems unlikely, based on the numbers, that 2022 is going to be a strong year. The guidance for 2022 calls for a 4% FFO increase – that’s before disposals, which should bring it to around 6%.

It’s my clear view that the fundamental upsides of this company, meaning its credit rating, the value of its portfolios, its pipelines, and its historical strength as well as ownership, weigh up the potential risks in this business.

Icade Valuation

Icade’s valuation is a matter of rising asset valuations and yield compression. In a downturn, Icade should underperform due to its non-premium asset quality, especially on the office side. Analysts are assuming voids and rent cuts to handle some of the tenant issues, coming to around a 5-7% revenue loss spread out over 2022-2025, though it could be more, including the combination of voids/vacancies, rent cuts, disposals and rent incentives. This is a conservative case – numbers may be better (or could of course be worse as well).

It’s my assumption that Icade will continue to be at the top in terms of beneficial lending. Liquidity will stay cheap, though the expectation is for debt spreads to rise around 100-200bp in Europe over the coming years. This will move into FFO and pressure the dividend, as well as the DGR.

The current mix of factors in Europe leads to only one conclusion. Don’t expect massively increasing NAV in 2022 and onward. We value Icade by using a straight NAV calculation based on GAV, which comes to around €15.2B on the gross asset side. Removing debt and commitments, we come to a €4.5B NAV, coming to a €60/share NAV valuation.

This gives us around 5-6% undervaluation when looking at the company’s current share price compared to NAV.

S&P Global and other analysts give the company a somewhat different forward case, instead choosing to believe in a continued NAV/FFO growth based on portfolio expansion and successful pipeline execution. The analyst target range begins at €61 and goes to €85, with an average of €71/share, to an upside of almost 25% from today’s valuation.

While it’s entirely possible that the company could go as high as that, I believe assuming higher than €62-€63 unfairly premiumizes the company’s portfolio compared to wha

t else you could be investing in at this time.

It’s true that this company does have some significant upsides, and the fundamentals are good.

Icade Financing breakdown (Icade IR)

However, the forward visibility in terms of yield compression continued vacancy increases, and other potential negatives are a bit too low for my taste to go all that high in terms of the company’s targets here.

Equity analysts give the company a somewhat higher valuation, but not as high as the S&P Global averages at just south of €65/share.

Icade Thesis (AlphaValue)

This, I believe, is a decent comprehensive review of how we could view the valuation for the company, as well as the potential upside at the current valuation.

Thesis

Contrary to popular belief, Europe does have a couple of REITs that are worth getting into, as well as straight real estate companies. I’ve looked at a few of them so far, and I intend to continue doing so.

Icade is an interesting mix of office, healthcare, and residential development with a 39% stake from the French government. These things, together with the fundamentals, make the company an appealing prospect to me. Once we’ve established that a company is an appealing prospect, what’s left to estimate is the valuation.

At anything below €63 per share, this company is where I would consider it a “BUY”. That’s where we currently are. I have not yet bought a beginning stake in Icade but may do so in the coming week. The company has appealing assets and fundamentals and makes a great addition to a well-diversified European/International investment portfolio.

Icade has an ADR, CDMGF, a 1:1 receipt with a relatively illiquid volume. As a result, I would say that the most successful investment is through the far more liquid, native listing in Paris.

I believe this company to be a solid addition to your portfolio if bought with the right expectations. The company’s yield is close to 6%, which is high in the sector, and high for the peer group.