You simply cannot browse an write-up about household genuine estate with no the author mentioning the affordability challenges that today’s customers facial area. There is no question residences are considerably less very affordable nowadays than they had been over the last two decades, but that doesn’t suggest residences are now unaffordable.

There are a few actions employed to build residence affordability: dwelling price ranges, mortgage fees, and wages. Let us glimpse closely at each individual of these components.

1. Residence Charges

The most recent Household Selling price Insights report by CoreLogic shows dwelling values have greater by 19.1% from final January to this January. That was a single cause affordability declined about the past yr.

2. Home loan Charges

When the current global uncertainty makes it challenging to challenge home finance loan fees, we do know latest fees are just about one complete proportion level increased than they had been last yr. According to Freddie Mac, the ordinary month to month amount for past February was 2.81%. This February it was 3.76%. That enhance in the home loan charge also contributes to houses currently being much less inexpensive than they ended up final calendar year.

3. Wages

The just one massive, optimistic element in the affordability equation is an improve in American wages. In a recent article by RealtyTrac, Peter Miller addresses that stage:

“Prices are up, but what about wages? ADP studies that task holder incomes increased 5.9% final calendar year but rose 8.% for all those who switched employers. In outcome, some of the better price tag to acquire a dwelling has been offset by far more dollars cash flow.”

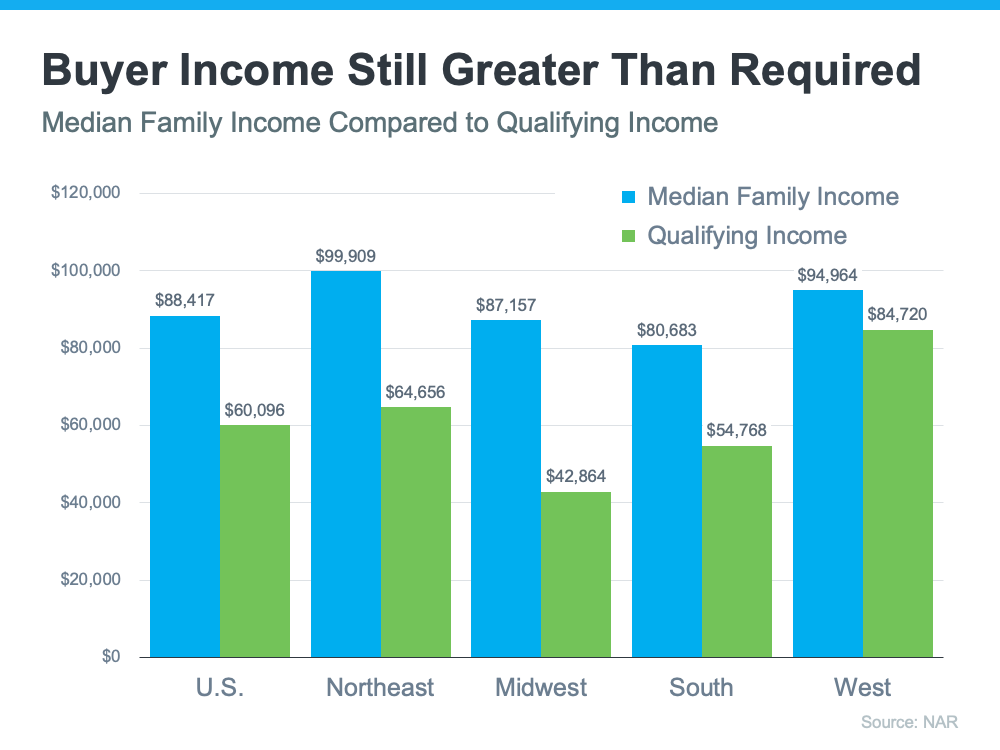

The Countrywide Affiliation of Realtors (NAR) also a short while ago introduced data that appears to be like at profits and affordability. The NAR data provides a comparison of the existing median loved ones earnings as opposed to the qualifying money for a median-priced household in each and every region of the nation. Here’s a graph of their results:

As the graph exhibits, the median relatives cash flow (demonstrated in blue on the graph) is greater than the qualifying money desired to invest in a median-priced dwelling (revealed in inexperienced on the graph) in all 4 areas of the nation. While these figures may possibly change in certain spots in just just about every region, it is critical to note that, in most of the region, properties are nonetheless cost-effective.

So, when you think about affordability, remember that the picture involves extra than just home prices and mortgage premiums. When price ranges increase and premiums increase, it does effects affordability, and specialists job the two of individuals things will climb in the months ahead. That is why it’s less affordable to purchase a household than it was more than the past two many years when rates and charges were being lower than they are now. But wages need to be factored into affordability as properly. For the reason that wages have been growing, they are a big reason that, while significantly less economical, houses are not unaffordable now.

Bottom Line

To find out far more about affordability in our neighborhood region, let’s discuss where household rates are domestically, what is taking place with home loan costs, and get you in call with a loan company so you can make an educated fiscal choice. Try to remember, whilst significantly less affordable, homes are not unaffordable, which even now presents you an possibility to get nowadays.

Phone Pinnacle Residential Attributes at 781-237-5000 to focus on your authentic estate needs.