Hispanolistic/E+ by way of Getty Pictures

No investor needs to contact Compass (NYSE:COMP) correct now, and the factors for that are easy to recognize. It is really a expansion inventory that is at present dropping income, which is just one of the worst spots to be in all through the volatile 2022 marketplace. On top rated of that, it can be a real estate enterprise – and with soaring charges and continued inventory tightness, all indications are pointing to a slowdown in transaction volumes, maybe to start out in the back again half of this 12 months.

But as regular, the market is taking a pretty quick-sighted approach to this inventory. When I take a step again from the quick-expression noise on Compass, I still see a enterprise that has swiftly boosted alone to the leading of the U.S. true estate sector in just a relatively brief number of years. It has become a residence brand title for the two dwelling purchasers and sellers, and has managed to continue getting industry share in an period wherever more organization is supposedly shifting to price reduction brokerages like Redfin (RDFN).

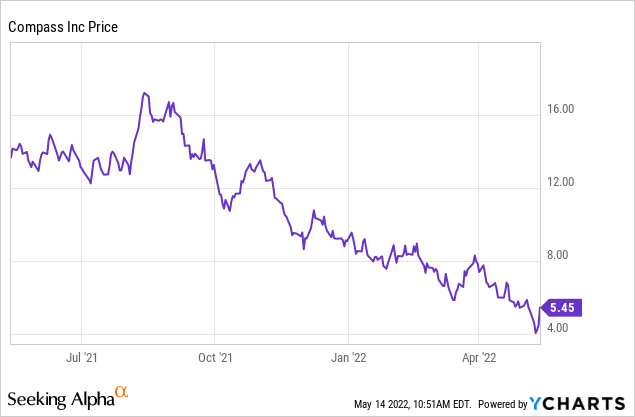

Yr to date, shares of Compass have lose 40% of their worth vs . highs earlier mentioned $17 that Compass notched previous August, the stock is down by much more than two-thirds.

The Compass bullish thesis revisited

Provided the steep fall in Compass stock around the earlier couple months, even with the fact that elementary overall performance proceeds to keep up, I am upgrading my watch on the inventory to sturdy get. I advise that investors double down on this dip as I have, and though Compass might have a rocky handful of months ahead as actual estate activity likely slows down (however I would argue this worry is previously baked into its stock rate), it can be even now well-positioned to be a prolonged-term winner.

This is a complete rundown of the reasons to be bullish on Compass:

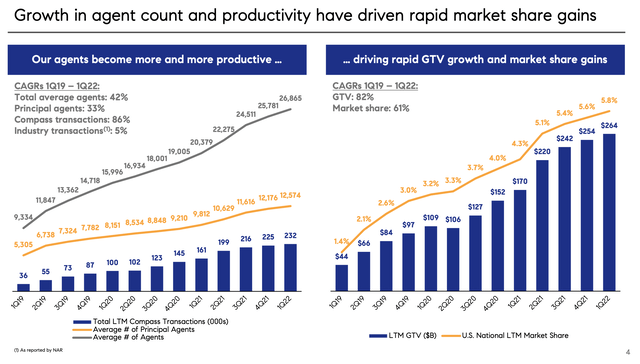

- Inside a number of many years, Compass has grow to be a dominant brokerage. Compass’ sector share of U.S. genuine estate transactions is growing fast to ~6%. Now deeply embedded into main coastal markets, Compass is a lot more lately pushing into new workplace prospects in the Midwest. There’s nonetheless place for even further enlargement: Even just after the new market place exercise this calendar year, Compass is even now penetrated into significantly less than 50 % of the U.S. populace.

- Tertiary income options. A short while ago, Compass has been opening the door to new monetization options, such as starting off its very own title corporation. This positioning helps Compass derive more wallet share from actual estate transactions as a complete. Compass has commented that connect premiums on these tertiary providers are increasing. Compass estimates its U.S. TAM is $240 billion, of which only $95 billion and the rest is coming from adjacent companies.

- Powerful branding. Compass constructed a brand close to becoming a entire-provider, higher-good quality authentic estate brokerage, really identical in type and profile to competitors like Berkshire Hathaway Dwelling Companies or Sotheby’s. This gives the enterprise a quite potent distinguisher in opposition to other tech-very first rivals like Redfin.

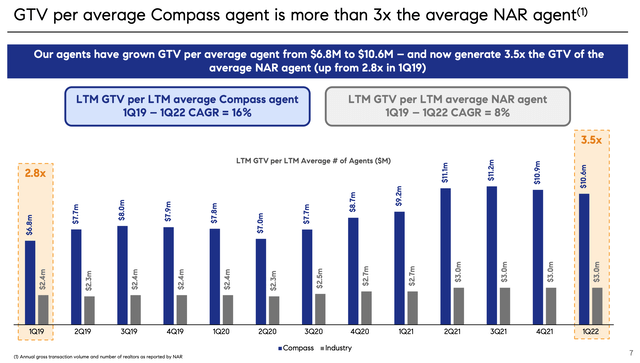

- Scalable system. Compass’ primary prices lie in the R&D expend to produce its know-how platform for Compass brokers, as properly as the sales and promoting expenditures of advertising its brand to homebuyers/sellers and opportunity new agents. These expenditures are scalable: as Compass’ scale grows, and as agent efficiency grows (the normal Compass agent generates 19% additional income in the 2nd year), Compass will be ready to make improvements to its profitability margins, which we have currently noticed in the firm’s latest final results.

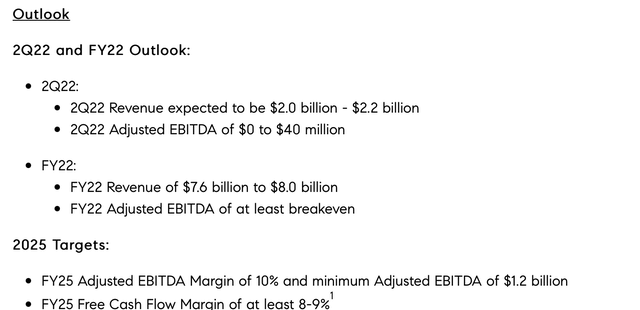

Be aware as nicely that Compass has guided to “at the very least breakeven” modified EBITDA this calendar year on a profits profile of $7.6-$8. billion (flat to final year, in which the firm produced $2 million of modified EBITDA), and that by 2025, the company is aiming to produce $1.2 billion of modified EBITDA. We will analyze the math at the rear of this in the upcoming portion.

Compass outlook (Compass Q1 earnings deck)

Meanwhile, at latest share charges close to $5, Compass trades at a market cap of just $2.33 billion. Right after netting off the $475.9 million of funds on Compass’ most recent equilibrium sheet, the firm’s ensuing enterprise benefit is $1.85 billion. This means Compass is investing at a portion of this year’s anticipated earnings, and at a <2x multiple of its 2025 targeted adjusted EBITDA.

There’s a huge opportunity here to be seized: don’t miss the chance while the entire market is looking the other way.

The path to profitability lies in adjacent services

One of investors’ biggest criticisms with Compass is that the company effectively bought its growth. This is, admittedly, partially true: Compass achieved tremendous market share so quickly because it took the approach of buying out existing brokerages and slapping the Compass logo on them. The argument that Compass makes in defense of this strategy, however, is that agent productivity rises over time (especially as agents are onboarded onto the Compass platform and brand) and that it will wring out profits on its acquisitions over time.

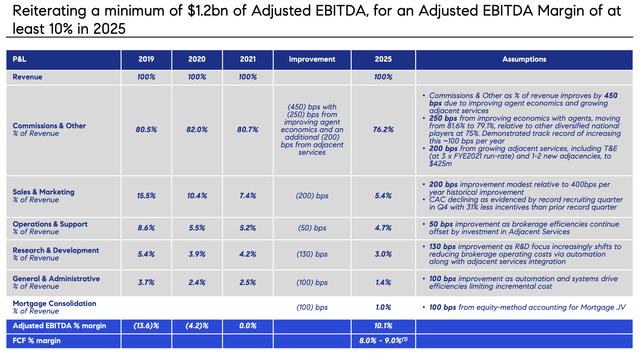

In 2021, the company achieved breakeven adjusted EBITDA margins. By 2025, the company aims to grow its revenue base by ~50% to ~$12 billion, and generate ~10% adjusted EBITDA margins on that revenue.

Compass operating model (Compass Q1 earnings deck)

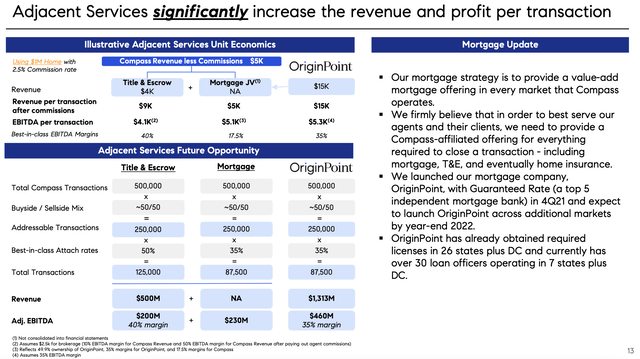

As can be seen in the chart above, the majority (450bps) of this adjusted EBITDA expansion from flat to ~10% margins is expected to be derived from better transaction economics. Of particular importance to Compass’ strategy going forward is expanding its adjacent services in other words, offering title, escrow, and mortgage services to the buy-side of its transactions.

The chart below illustrates the incrementally of these offerings. Title and escrow alone can nearly double Compass’ net revenue per transaction, and mortgage offerings through the company’s new OriginPoint subsidiary can deliver substantially more than that.

Compass adjacent services (Compass operating model)

Note that these are relatively newer offerings. OriginPoint originated its first mortgages just in Q4. And in May, Compass acquired a title company called Consumer’s Title Company of California, which is licensed in every county in the state of California. At present, title and escrow services are only used on a mid-single digit percentage of Compass’ buy-side transactions, pointing to massive opportunity for the company to continue to cross-sell this product with its agents.

Growth still robust

And despite fears of a near-term housing market collapse, we haven’t seen any deterioration just yet in Compass’ results.

In Q1, Compass grew its revenue at a robust 26% y/y pace to $1.4 billion, representing a Q1 record for the company. The chart below shows as well that Compass ended Q1 at a 5.8% trailing twelve-month market share of U.S. real estate, up 150bps y/y. For Q1 alone, Compass’ market share was even higher at 6.1%, up 90bps versus 5.2% in the year-ago Q1.

Compass growth metrics (Compass Q1 earnings deck)

Agent productivity also remains incredibly high. Compass isn’t just growing by adding more agents to its network, its agents are also producing much more than the industry average. As shown in the chart below, the average Compass agent generated $10.6 million in gross transaction value over the past twelve months – which is 3.5x more than the typical agent in the industry.

Compass agent productivity (Compass Q1 earnings deck)

Here’s some helpful anecdotal commentary from Compass’ outgoing CFO Kristen Ankerbrandt on how the company is seeing the real estate market shape out for the rest of the year, made during her prepared remarks on the Q1 earnings call:

The first six weeks of the second quarter have resulted in tougher times across all industries. These headwinds along with constrained inventory contributed to a slower start to the second quarter than we expected. As a result our Q2 revenue outlook was affected as you will see in our second quarter guidance.

But despite uncertainty in the current macro environment, we still expect market growth in our markets in 2022 as a result of strong continued demand and historically low inventory that is driving prices higher. Home prices would have to reverse their current upward trend and fall dramatically to turn market growth negative. We do not believe this will occur particularly with prices in our markets continuing to increase.

Key takeaways

I remain focused on the long-term opportunity for Compass to continue gaining market share and driving significant margin expansion through improved agent productivity and cross-selling adjacent services. The long-fragmented and localized real estate industry is moving toward national consolidation, and Compass has emerged as the leading national brand. Stay long here and buy the dip.