A appear at the shareholders of Granite Real Estate Investment Belief (TSE:GRT.UN) can convey to us which group is most powerful. Large companies generally have establishments as shareholders, and we normally see insiders owning shares in scaled-down companies. Companies that have been privatized tend to have minimal insider possession.

With a market capitalization of CA$6.7b, Granite Actual Estate Expenditure Belief is alternatively significant. We might assume to see institutional investors on the sign up. Firms of this sizing are typically perfectly recognised to retail investors, much too. Taking a glimpse at our information on the possession groups (underneath), it seems that institutions personal shares in the corporation. We can zoom in on the various ownership teams, to understand additional about Granite Real Estate Investment Have confidence in.

Test out our hottest analysis for Granite Actual Estate Investment decision Have confidence in

What Does The Institutional Ownership Explain to Us About Granite Actual Estate Expense Rely on?

Quite a few institutions evaluate their effectiveness from an index that approximates the neighborhood industry. So they commonly pay back much more focus to providers that are bundled in big indices.

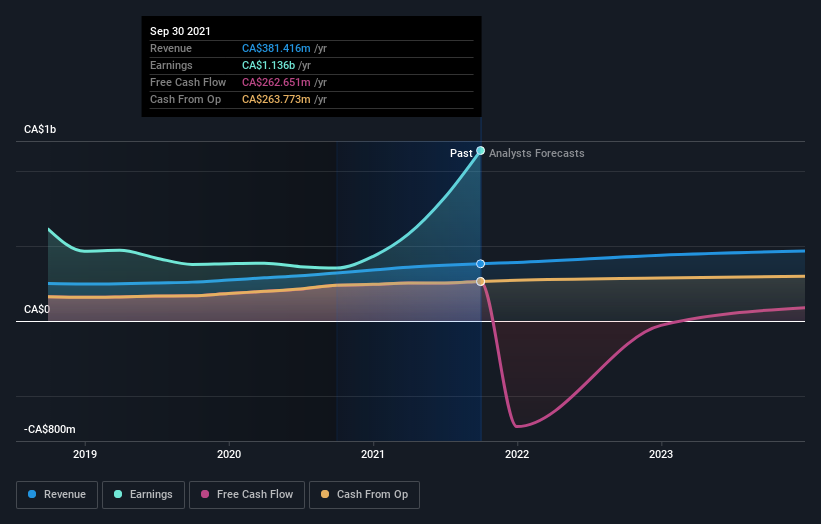

We can see that Granite Genuine Estate Financial investment Rely on does have institutional buyers and they maintain a very good part of the company’s stock. This implies some reliability amongst skilled traders. But we can’t depend on that point alone because establishments make bad investments at times, just like every person does. It is not unheard of to see a huge share price tag drop if two big institutional buyers attempt to sell out of a stock at the identical time. So it is truly worth examining the past earnings trajectory of Granite True Estate Financial investment Belief, (down below). Of training course, retain in mind that there are other aspects to take into account, far too.

Since institutional investors personal a lot more than fifty percent the issued inventory, the board will most likely have to fork out focus to their preferences. We be aware that hedge cash don’t have a meaningful financial commitment in Granite Authentic Estate Investment Trust. Our information displays that Connor, Clark & Lunn Investment Management Ltd. is the major shareholder with 4.9% of shares excellent. For context, the 2nd most significant shareholder holds about 4.8% of the shares superb, adopted by an possession of 4.5% by the 3rd-largest shareholder.

A nearer search at our ownership figures indicates that the top 25 shareholders have a mixed ownership of 51% implying that no one shareholder has a the vast majority.

Investigating institutional ownership is a very good way to gauge and filter a stock’s anticipated effectiveness. The exact same can be obtained by studying analyst sentiments. There are a good deal of analysts covering the inventory, so it could be really worth looking at what they are forecasting, way too.

Insider Possession Of Granite Authentic Estate Expense Trust

The definition of an insider can vary marginally amongst unique nations around the world, but associates of the board of administrators normally count. Management in the long run responses to the board. Nonetheless, it is not uncommon for professionals to be executive board associates, primarily if they are a founder or the CEO.

I typically take into consideration insider ownership to be a fantastic issue. However, on some instances it will make it much more difficult for other shareholders to keep the board accountable for conclusions.

Our facts indicates that insiders have below 1% of Granite Authentic Estate Financial commitment Have faith in in their have names. Retain in mind that it is a significant company, and the insiders individual CA$14m well worth of shares. The absolute value may be much more important than the proportional share. It is fantastic to see board associates owning shares, but it could possibly be value checking if those people insiders have been buying.

Standard General public Ownership

The basic community– together with retail traders — individual 34% stake in the corporation, and for this reason cannot effortlessly be ignored. Though this dimension of possession could not be adequate to sway a plan selection in their favour, they can still make a collective impact on organization guidelines.

Following Techniques:

Whilst it is effectively worth contemplating the distinct teams that have a enterprise, there are other factors that are even far more crucial. Look at for instance, the ever-current spectre of investment decision risk. We’ve discovered 2 warning signals with Granite Real Estate Financial commitment Have confidence in , and comprehension them really should be section of your financial investment method.

But ultimately it is the potential, not the previous, that will ascertain how very well the owners of this business enterprise will do. Therefore we think it a good idea to take a glance at this free of charge report showing regardless of whether analysts are predicting a brighter potential.

NB: Figures in this report are calculated working with knowledge from the past twelve months, which refer to the 12-month period ending on the past date of the thirty day period the economic assertion is dated. This may not be dependable with comprehensive 12 months annual report figures.

Have feedback on this article? Worried about the material? Get in touch with us straight. Alternatively, email editorial-workforce (at) simplywallst.com.

This post by Simply just Wall St is standard in mother nature. We present commentary dependent on historical knowledge and analyst forecasts only making use of an unbiased methodology and our content are not intended to be money information. It does not represent a suggestion to get or sell any stock, and does not choose account of your aims, or your economical predicament. We intention to deliver you prolonged-phrase focused evaluation pushed by essential information. Notice that our investigation may not factor in the most up-to-date price-sensitive firm announcements or qualitative product. Simply Wall St has no posture in any stocks outlined.